Federal Grant Accounting: Direct vs. Indirect Costs for Nonprofits

Attention nonprofit leaders! Federal grant accounting might seem daunting, but understanding terms like direct and indirect costs can significantly simplify the process. Let’s break them down.

1. What Are Direct Costs in Federal Grants?

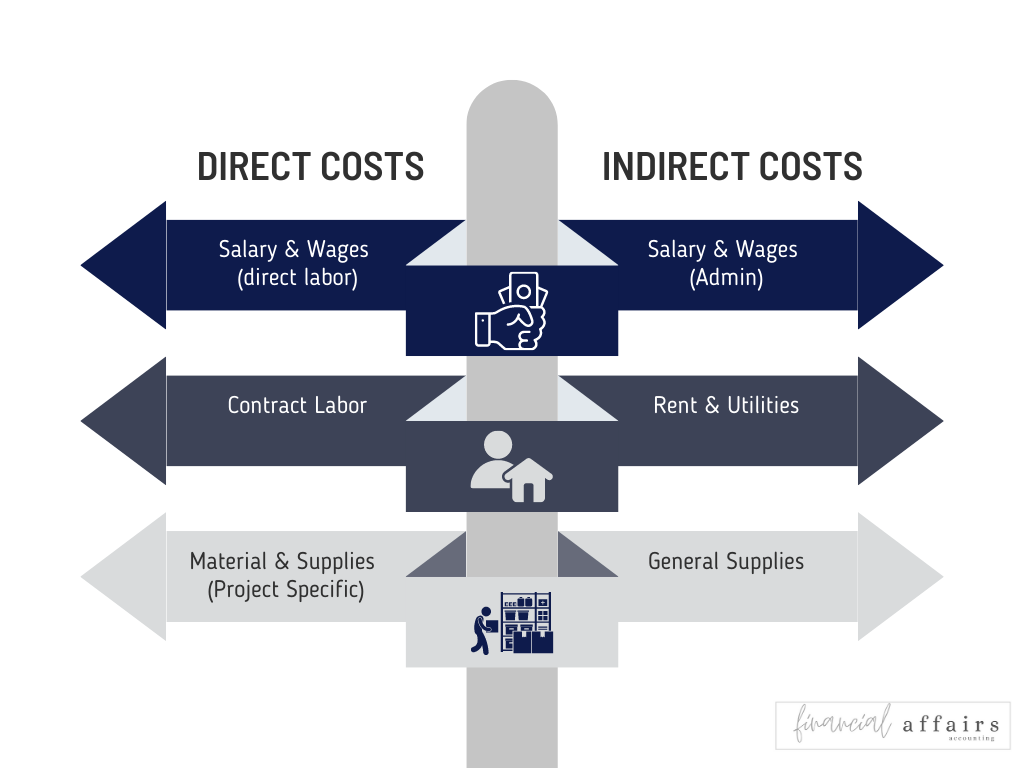

Direct costs are expenses traceable to a specific project or activity funded by the federal grant.

Examples of Direct Costs:

Salaries of project-specific employees.

Materials and supplies for the project.

Project-specific travel expenses.

Equipment for the grant project.

Ensure direct costs are:

Allowable: Per the grant's guidelines.

Allocable: Assigned entirely to the grant project.

Reasonable: In line with market rates.

2. Indirect Costs: The Overheads in Grant Accounting

Indirect costs support your nonprofit's general mission and aren't exclusive to one project.

Examples of Indirect Costs:

Office utilities.

Salaries of administrative staff.

General office supplies.

Office rent and maintenance.

Indirect costs often have an "indirect cost rate," a percentage indicating the ratio of indirect to direct costs. Check out this amazing resource from Colton Strawser and Blackbaud on “Accounting for the Full Cost of Impactful Programs”.

3. Why Distinguishing Direct from Indirect Costs Matters

Correctly categorizing costs ensures grant compliance. Misallocations can lead to penalties or loss of funding.

Key Takeaways:

Document and categorize costs accurately.

Maintain clear accounting records.

Periodically audit your costs.

Conclusion

Mastering the nuances of direct and indirect costs in federal grant accounting is pivotal for nonprofits. Need expert guidance? Financial Affairs specializes in assisting nonprofits like yours. Reach out today!

For a deeper dive into direct and indirect costs, check out our guide on the subject below.