Nonprofit Financial Statements Explained

As a nonprofit, it is important to have a basic understanding of accounting terms. This will help you make more informed decisions about your organization's financial health. Nonprofit organizations much like for-profit companies rely on their financial reports to understand the health of the organization. A common misconception is that nonprofit organizations cannot generate a profit. I have seen posts from bookkeepers on Facebook that have a new nonprofit client that had a profit at the end of the year, and they are not sure how to account for that to show no profit at the end of the year (YIKES!). Nonprofit organizations rely on creating a profit at the end of the fiscal year to reinvest those funds back into the organization to continue growing their programs and furthering their missions.

In this blog post, we will define some key accounting terms and explain what they mean for your nonprofit. By understanding these concepts, you will be able to better manage your budget and keep your organization on track!

What is nonprofit accounting?

Nonprofit accounting is a specialized area of accounting that nonprofit organizations use to manage their finances. It focuses on ensuring that nonprofit organizations have the funds they need to operate and meet their goals while also striving to make sure that nonprofit organizations use their funds effectively and efficiently. The goal of nonprofit accounting is to provide financial accountability and transparency for nonprofit organizations.

Nonprofit accounting is an important tool for nonprofit organizations because it helps them to track their income and expenses and to make sure that they are using their funds in the most effective way possible.

Cash vs. Accrual accounting

Cash-basis is a method of recording revenue only when the income is received and recording expenses only when they are paid. Some small nonprofits use cash-basis rather than accrual-basis accounting to record expenses and revenues. While cash basis accounting can be easier to interpret, it is not recommended for nonprofits to use a cash basis method of accounting under GAAP (Generally Accepted Accounting Principles).

Most organizations use the accrual basis of accounting (or a modified accrual basis).

Under the accrual method, an organization recognizes revenue when the services have been provided or when the grant is promised, independent of the time when the organization receives the money. Meaning if you receive an email announcing you are the recipient of a $50,000 grant, you can recognize that revenue on your statement of activities today rather than when you receive the funds.

Similarly, under accrual, expenses are recognized when they are incurred rather than when they are paid.

Statement of Activities

In nonprofit accounting, the statement of activities (or income statement) represents an organization’s bottom line, reporting on the changes in net assets of the nonprofit and characterizing the revenue and expenses accordingly. The statement of activities report can be reported on a consolidated basis, by department, location, restriction, or by program.

Terms used to describe operating results are:

Revenue- The money coming into the organization as a result of donations, grants, or selling goods or rendering services.

Expenses- Money that goes out to pay for goods or services needed to conduct the activities of the organization.

Net Income (Profit)- Excess of revenues and gains over expenses for a period

Below is an example of a statement of activities report:

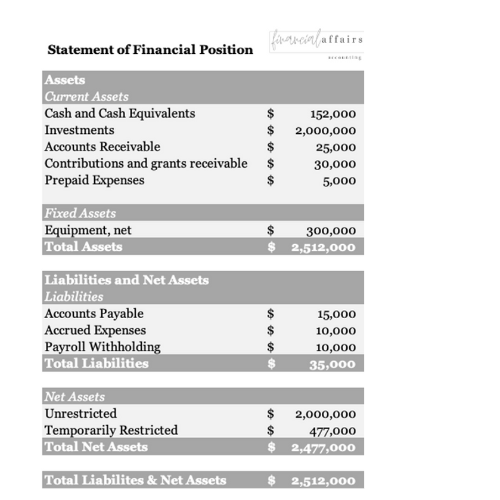

Statement of Financial Position

The balance sheet presents a summary of an organization’s financial position at a given point in time. Nonprofits leverage a statement of financial position instead of a balance sheet since they do not have stakeholders in the organization. This document is designed to show your nonprofit’s assets. Instead of identifying these assets to distribute them to stockholders, they are intended to be reinvested into the nonprofit.

Terms used to describe financial position are:

Assets indicate what the organization owns - Resources or economic benefits held by the organization as a result of past transactions.

Liabilities indicate what the organization owes in unpaid bills or debt - An obligation to pay a definite (or reasonably definite) amount at a definite (or reasonable definite) time. Liabilities are incurred when an organization receives a benefit but has not yet paid for it.

Net Assets represent the classification of finances that have been made in the organization according to its restriction on use. (Assets minus liabilities)

Net assets may be:

Unrestricted net assets

Temporarily restricted net assets

Permanently restricted net assets

Below is an example of a statement of financial position report:

Statement of Functional Expenses

The statement of functional expenses is a tool used by nonprofit organizations to effectively and accurately allocate their expenses. By classifying expenses according to how they are used within the organization, nonprofits are able to get a better sense of where their funds are going and how they can best be used. This information is then used to make strategic decisions about how to allocate resources to further the nonprofit's mission. In short, the statement of functional expenses is an essential part of nonprofit accounting and decision-making.

Most organizations have to report their financials in two ways: by program and by function. Programmatic reporting is pretty straightforward—it focuses on how much was spent on a specific program or set of programs.

Functional reporting is a little more complicated. It divides expenditures into categories like “administration,” “fundraising,” and “program expenses.” This type of reporting is important because it shows donors how their money is being spent, and it helps the organization track where they might be able to cut costs. The number of functional expenses varies from organization to organization, but it doesn’t necessarily reflect the organization’s financial health. In fact, a broad range of functional expenses can actually be a good thing, because it shows that the organization is doing a thorough job of tracking its expenses.

Most organizations have three primary functional expenses:

Administrative

Fundraising

Programming

Below is an example of a statement of functional expense report:

Statement of Cash Flows

The statement of cash flows is a financial report that shows how cash moves in and out of an organization regularly.

This report is pulled every month and is typically composed of three primary sections. These sections include the cash flows from:

Operating activities

Investing activities

Financing activities

The statement of cash flow can help the organization understand how cash flows in their organization and help decision-makers plan for the future. For example, if you notice that the flow of cash in your organization is always lower in the first quarter of a new year (typical for nonprofits) then you will want to boost your year-end campaigns/donations to help offset the slower cash months.

Below is an example of a statement of cash flow report:

Key differences between for-profit and nonprofit financial reports

Conclusion

Every nonprofit should review its financial reports every month with the key decision-makers of the organization. All leaders of an organization should understand their financial reports and the financial health of the organization.

To pull these financial reports, the organization's data has to be recorded timely and accurately into the accounting software. The organization's bookkeeper or accountant should be able to assist with pulling these data.

Leave the tedious paperwork, tough calculations, and compliance regulations in our hands! We will work with your organization to produce timely, accurate, and trustworthy reports each month!